Why do the majority of women stay out of finance?

Although women are eager to learn more about financial planning, financial planning for women generally gets handed over to men.

Women should feel equally empowered to make financial decisions, especially in times of financial stress, like COVID-19.

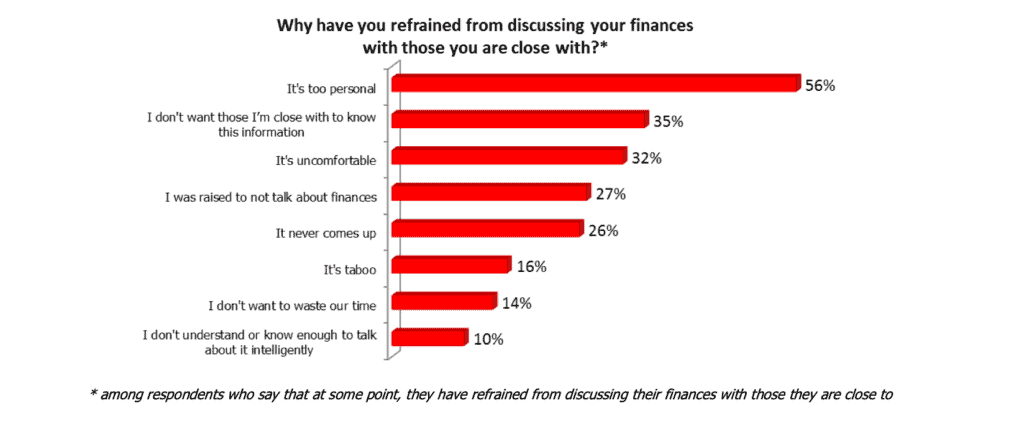

Only 47% of women would feel confident discussing money on their own and 8 in 10 women admit that they refrain from discussing finances with others. The Money Fit Women study by Fidelity shows that women have various reasons why they have often refrained from discussing finances with friends or family (see below).

Studies show that most people who lack financial knowledge are women. But studies also show that 92% of women desire to learn more about finance and are genuinely interested in money and financial planning.

In this article, I will cover five simple tips on how women can learn financial planning on their own.

5 free tips to learn financial planning for women

- Analyze and change your attitude towards money

- Review your personal financial goals

- Take advantage of free courses

- Read financial topics daily

- Follow social media accounts that are focused on personal finance

Let’s dive deeper into each one of these.

1. Analyze and change your attitude towards money

First, you have to analyze and change your attitude towards how you think about money. Up until this point, our thoughts about money have constructed how we each think about it today. Most times, our thoughts are limiting beliefs that hold us back. To produce new thoughts about money, you must take action to change your preexisting beliefs about money.

• Were you raised to think money was terrible to talk about?

• Did you have people tell you that others will take care of your money for you?

• Do you believe finance is complicated or that money is confusing to learn?

Whatever you have thought about money up to this point needs to change in order to move forward. Right now, write down three of your limiting beliefs about money and three ways to restructure your thought into self-affirmation.

Limiting Belief Example: “I am not smart enough to learn about investing.”

Reconstructing example: “I am smart enough to learn about investing and will start by taking action by watching a youtube video on investing basics.”

2. Review your personal finance goals

Second, you should review your personal finance goals.

After reviewing your beliefs about money, you should look over your financial goals. Use the same technique above (to change your attitude about money) towards your financial goals.

Example of a goal: “I want to take a 3-week vacation in Europe someday but can’t afford it.”

Restructuring example: “I will take a 3-week vacation in Europe by saving $100 month from my paycheck towards it.”

3. Take advantage of free courses

If you are reading this article, I can believe that you have access to the internet. The internet is FULL of free courses about personal finance. Here are a few free courses on financial fundamentals.

- Learn and Master the Basics of Finance (Udemy)

- Introduction to Financial Modeling (Udemy)

- Finance for Non-Finance Professionals (Coursera)

4. Read financial topics daily

One of the easiest ways to learn finance is by reading financial news every single day. Just by reading finance news, you will learn new words and ideas.

Be consistent in reading. Schedule 10 minutes a day on your calendar to read any financial news. Here are a few that I read:

• Yahoo Finance

• Market Watch

• Financial Times

5. Follow finance-related social media accounts

If you already spend time on social media, make sure to incorporate some financially focused accounts by following finance accounts. There are tons of finance accounts on Instagram and TikTok that teach valuable things.

Although social media is mainly to see what friends and family are up to, it’s a good idea to follow people and influencers who talk about things outside of your social circle. In just a few seconds, you can watch an Instagram story or TikTok video that teaches you something new.

- My Instagram @feelinfinancy

- Financial Lioness @financiallioness

- Dave Ramsey @daveramsey

- Suze Orman @therealsuzeorman

- Logical Finance @LogicalFinance (TikTok)

Closing thoughts

If you are interested in learning more about financial planning, there are many ways to start. Financial planning for women can quickly be learned through a variety of sources, for free.

To get started in learning financial planning for women, begin by reviewing your attitude towards money and your personal finance goal. Then, take advantage of free online finance courses, financial news, and financial-based social media accounts.

Let me know how it goes!

Xoxo,

Ashley

Ashley is a finance graduate from the University of San Francisco and currently works at a financial technology startup in San Francisco that is focused on providing affordable and accessible 401(k) retirement plans to other startups and small businesses. Prior to working at a startup, she was an associate at a large private wealth management firm working with high-net-worth clients. She is born and raised in Orange County, CA, and loves spending time at the beach, in a pool, reading, and with her friends.