Investing is a powerful tool that many people are too afraid to try.

By not understanding how investing money works, you miss out on valuable returns and lose the power of having your money work for you.

In one of my previous posts, “Why Compound Interest Matters and Why it Literally Pays to Start Saving Early,” I discuss the secret ingredient to investing: compound interest.

Even if you are just starting to invest or only just began learning about investing, things can get complicated fast.

Or you may already be invested but still have some questions or concerns about it. Sometimes it is hard to understand where money is actually going and what it is doing while being invested.

In this article, I will discuss compound interest’s best friend – time, and why time plays a valuable rule when it comes to investing early.

When you invest early, you better take advantage of compound interest returns, which increase over time. If your money is invested in the market for 20 years versus 40 years, you better bet that you will see a larger return over 40 years. Because of the time value of money, time is on your side!

If you are interested in learning more about compound interest basics, how compound interest is calculated, the time value of money, and the rule of 72, you might find it helpful to read my previous post on compound interest first.

In this post, I will outline the benefits of investing early on in your life and how to start to invest without risking all of your money.

Although “early” is somewhere in your twenties or thirties, please note that you are never too old to start investing and that your future self will thank you no matter your current age.

5 Reasons to invest early:

- The power of compound interest

- Your expenses are usually much lower when you are younger

- You will be able to take control of your finances at a young age and be prepared as you get older

- You will most likely be able to retire early

- You won’t regret investing early on in your life

Let’s dive into each reason why you should invest early a bit deeper

1. The power of compound interest

As noted in my previous article about compound interest, compound interest is the best reason to start investing early.

In all types of investing, compound interest is the secret ingredient that makes your money grow over time.

If you just let your cash sit in a bank or your bedroom somewhere, you will not be taking advantage of compound interest returns.

Here is a quick example of how compound interest works:

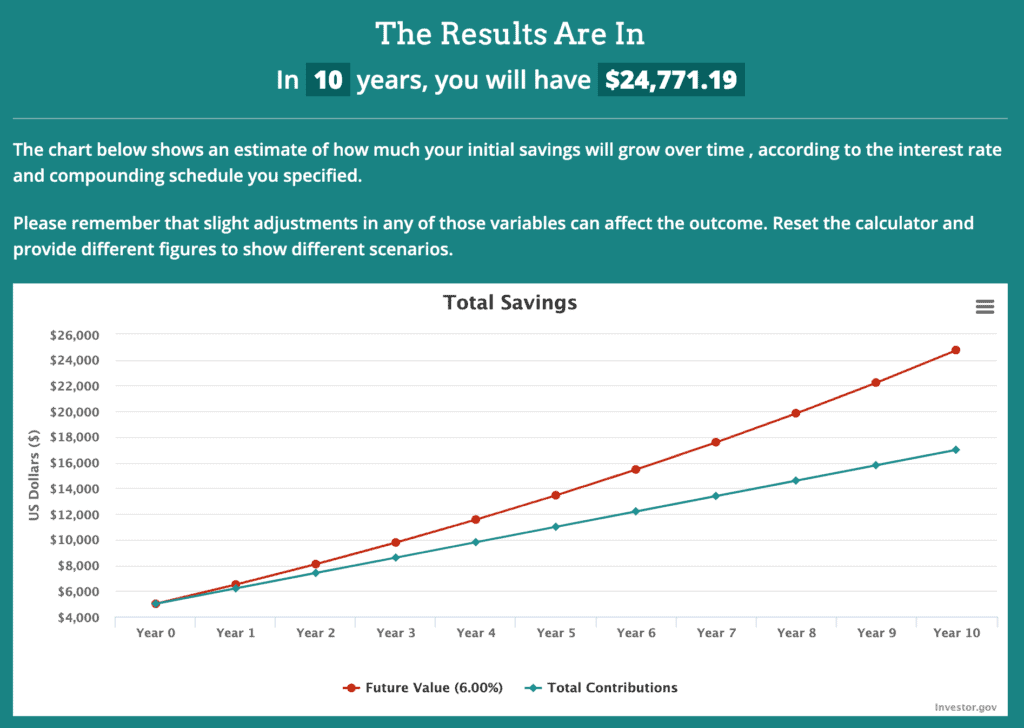

#1: Assume that you started investing later on in life and only have ten years until you’ll need the money.

- $5,000 initial investment

- $100 monthly contribution

- 10 years in time

- 6% interest rate (estimated)

- Compounded annually

After 10 years of investing, you will have an estimated $24,771.19. Hey, at least that is better than your original $5,000!

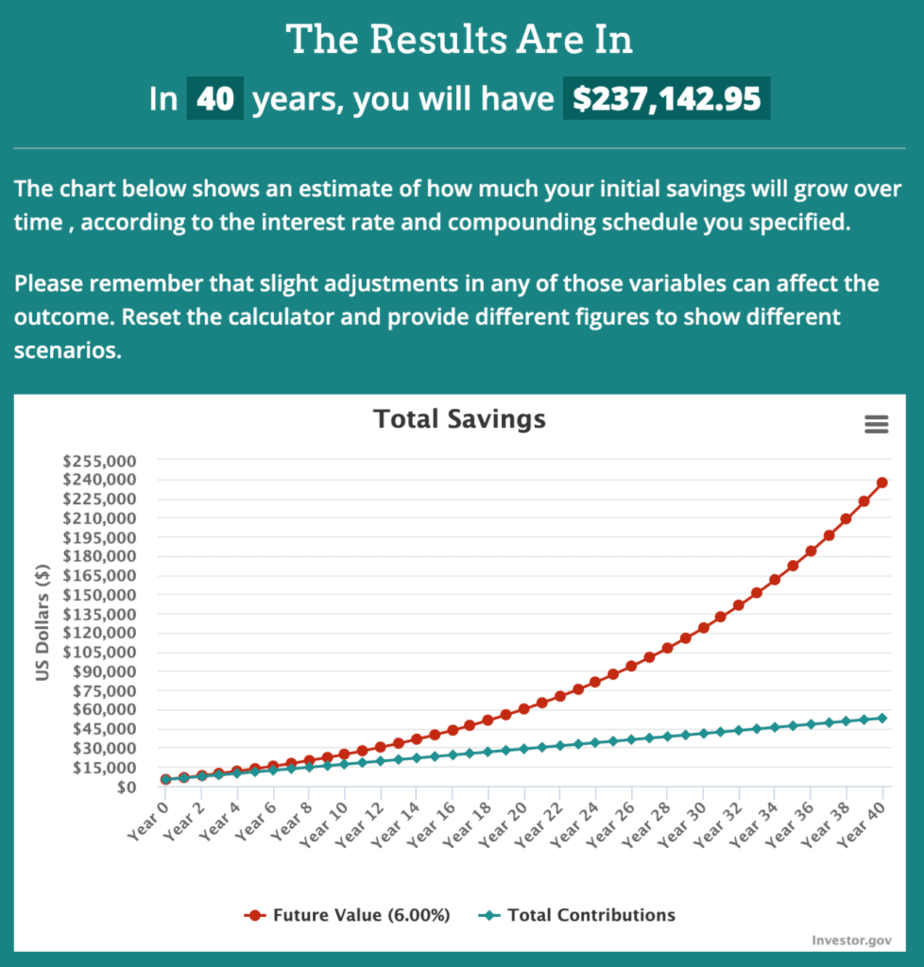

#2: Assume that you started investing in your twenties with the same exact amount, contributions, and interest rate. However, you had a much longer time of 40 years.

- $5,000 initial investment

- $100 monthly contribution

- 40 years in time

- 6% interest rate (estimated)

- Compounded annually

After 40 years, you would have a total of $237,142.95! Just by letting your money work for you.

In just a short example, you can see the difference that time makes on investment returns.

By investing the same amount of money with the same contribution amount and interest rate, you will notice that time is the best ingredient to your money’s growth.

If you are interested in playing around with the numbers and seeing how compound interest works yourself, check out this free tool on investor.gov.

2. Your expenses are usually much lower when you are younger

Naturally, your expenses will be lower when you are younger.

This idea that your costs are lower when you are younger is just an assumption, but most people’s expenses will indeed increase as they get older.

Although these numbers won’t reflect everyone, here is an age versus spending study published by Visual Capitalist to show that the younger you are, the less you probably spend:

Less than 25 Years Old – $31,102 in spending

Between 25-34 Years – $48,928 in spending

Between 45-54 Years – $64,781 in spending

Part of the reason spending increases as age increases is due to salary increases, taxes, and more responsibilities that age brings such as children and family.

If you are young and invest early on, you will take advantage of time in the market and compound interest.

3. You will be able to take control of your finances at a young age and be prepared as you age

If you take small steps to control your finances at a young age, you will eliminate most worries and stress that money will cause you in your life.

As you get older and older, you will want to do things like buy a home, buy a car, or further your education – which all cost money to do.

Money is not the answer to it all, but money is a big part of your life, and what you will be able to do, afford, and give away will revolve around money.

Learning how to invest early will give you more freedom to decide what you want to do later on and will also be an invaluable skill and habit to forrm in your life.

4. You will most likely be able to retire early

Did you know that 64% of Americans aren’t prepared for retirement?

Imagine working so hard your entire life to end up not being able to have a comfortable and enjoyable retirement.

What is the point of working so hard if you can’t relax and enjoy your life?

If you learn how to invest your money at an early age, you will be able to retire when you want to without question.

Retirement is usually the last thought for most people, and it’s because they think it won’t happen anytime soon and that they will figure it out later.

This is wrong! The sooner you start thinking about retirement, the more you will have to enjoy it later on. We are all aging minute by minute.

5. You most likely will regret it if you don’t invest early on

As much as we would like to think that there will be an ample amount of time to grow our money, figure out our future plans, and invest sometime later on, it is just not true.

Not to scare you, but time catches up to us quickly, and if we are not prepared or have a robust financial plan, there will be nothing to save you.

Why should you invest early?

If you invest your money early on (whether that is in your twenties, thirties, or forties), you will be able to take advantage of the power of larger returns due to compound interest and time.

It is always better to start investing early in your life, and you will be one step ahead of someone who only keeps all their money in the bank.

How can I start investing early?

The best way to start investing early (with a minimal amount of money) is through Robo-advised platforms.

Although Robo-advisors vary in costs and minimums, Robo-advisors provide great investment management advice and investing tools via automated technology.

Most Robo-advisors work similarly by creating a “risk-preference” setting based on a variety of questions. These questions include your income, current cash balance, age, time horizon, debt amount, and more things related to that in order to figure out what you should be investing in.

Robo-advisors act as financial advisors – but most of the time, unlike financial advisors, Robo-advisors do not include a real human being who is actively managing your portfolio.

I personally use Wealthfront as a Robo-advisor.

What is a good age to start investing?

The best age to start investing is as young as possible.

Ideally, your twenties are a great time to start investing because you are old enough to have an income and can tolerate a good amount of risk to enable your money can grow.

How should a beginner invest $1,000?

If you are a beginner investor, investing can sound intimidating. But congrats that you have saved $1,000 and are ready to make it work for you!.

Again, deciding to use a Robo-advisor is probably the best idea for an $1,000 investment.

Robo-advisors usually don’t charge a high amount to get started and have low minimums to give more people access to an investment platform.

Another great option is to invest the $1,000 into a 401(k) account. There are different types of retirement accounts, including a traditional and a Roth 401(k).

If you want to learn more about 401(k) types, feel read to learn more about 401(k)s in my article “Congrats, Your Employer Offers a 401(k) – But Which Option is Best?”

What is the best investment calculator to use?

Although you could calculate investment returns by hand, an investment calculator is a great and easy tool to have handy.

One example of an investment calculator that you can use is calculator.net.

Quotes to encourage you to invest early

“When you invest, you are buying a day that you don’t have to work.”

Aya Laraya

“Yes, we all can make lot’s of money while sleeping, if we invest early in our life.”

Amit Kumar

I made my first investment at age eleven. I was wasting my life up until then.”

Warren Buffett

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.”

Albert Einstein

“Investing is laying out money now to get more money back in the future.”

Warren Buffett

Closing thoughts

Investing your money early on is very powerful.

Whether you invest a few dollars or a few hundred dollars from each paycheck, you will be making a very influential impact on your financial life. Investing may sound scary or foreign, but I hope to shed light on it to make things less intimidating.

If you are young, I hope you learned how important age is when investing and how valuable time is in the market.

You don’t want to be someone who regrets not investing their money because you were scared or unsure of how to do it.

It doesn’t take much to invest at the end of the day, you don’t have to be a millionaire to get started, and again, your future self will thank you.

What are your thoughts on investing, and would you give any investment advice to your younger self?

Ashley is a finance graduate from the University of San Francisco and currently works at a financial technology startup in San Francisco that is focused on providing affordable and accessible 401(k) retirement plans to other startups and small businesses. Prior to working at a startup, she was an associate at a large private wealth management firm working with high-net-worth clients. She is born and raised in Orange County, CA, and loves spending time at the beach, in a pool, reading, and with her friends.

[…] The earlier you start investing, the earlier you will utilize the power of compound interest and time. If you want to learn more about investing without risking it all, read my article, “5 Great Reasons To Invest Early and How to Without Risking It All.” […]