At first, saving $1,000 may seem hard to achieve. But when you break it down into smaller pieces, saving $1,000 really isn’t very difficult if you make it a goal of yours. Saving $1,000 can be a great way to build your emergency savings fund or just build confidence behind your saving decisions.

Ideally, once you save $1,000, you’ll probably be encouraged to continue saving, leading to a much higher personal savings bucket in the long run.

Saving $1,000 can be great for various reasons – to pay down debt, create emergency savings, travel more, or invest in the stock market.

If you want to learn how you can quickly save $1,000, this article will help you! Saving $1,000 can be better achieved with a few simple steps:

- Create a reasonable timeline for your goal

- Get into the saving mindset

- Create a budget up and actually use it

- Break down your savings goal and create an achievable roadmap

- Evaluate your current income

Create a reasonable timeline for your goal

If you are serious about saving $1,000, you will be able to! The first step towards your goal of saving $1,000 is to create a reasonable timeline as part of your savings goal.

Your timeline should be reasonable for your particular needs. Do you need to have $1,000 for a specific event or purchase? Or do you just want to create better emergency savings? These types of questions will help you discover the why behind saving $1,000.

I think that a month or two should be a good enough amount of time for you to save $1,000 depending on your goal, current income, and saving habits.

It may not seem easy to set a specific time or date to save $1,000, but creating an actual date of when you want to achieve a goal is proven to be the best way to reach goals.

Deadlines or specific dates encourage you to commit to your goal better. Even if you don’t perfectly hit your goal savings date, you will feel more encouraged than if you didn’t set a timed date.

Get into the saving mindset

Getting into the “saving” mindset is a critical part of your savings success – not just for $1,000 but for the rest of your life.

As mentioned previously, starting any goal starts with a positive attitude and the belief that you can do it!

No matter if your goal is $1,000 or $1,000,000, a positive money mindset will be critical to your success. Reaching financial success and financial soundness will only be possible with a good attitude.

There are many ways to adopt a more positive attitude towards money, but one of my favorite ways is practicing money-related affirmations.

Some money mindset affirmations include:

“I am worthy of financial security and success.”

“I am an abundance of money and resources.”

My life is full of wealth, health, and success.”

Most success is formed through ourselves and our mindset. If you want to get good at anything, whether that is a sport, instrument, or new concept, you’ll have to surround yourself with the proper support and self-motivation.

If you genuinely believe that you are just a lousy saver or bad with money, those thoughts will likely turn into your reality and will negatively affect what you think about yourself.

Do you have a sticky note or whiteboard near your work or nightstand? Start writing yourself positive words of encouragement and look at it daily.

Small doses of encouragement like “you got this!” will slowly empower you to be more positive in other aspects of your life, such as saving.

Create a budget and actually use it

Creating and sticking to a budget is never the most fun. But if you want to achieve a specific monetary goal, such as saving $1,000, you will need to budget.

There are many different ways you can create and track your spending, so you will need to find what works for you.

Do you prefer to keep a notes page on your iPhone, writing it down with pen and paper, or keeping a running google doc? You may need to try a few different budgeting methods before finding the one that works for you.

An expense tracker and budget will allow you to identify the gaps in your saving and spending habits to see where your money is going.

If you don’t know where to start with a budget, check out my free budget tracking PDF that you can download or print out (whatever floats your boat!)

“Do not save what is left after spending, but spend what is left after saving”

Warren Buffett

Break down your savings goal and create a roadmap

Now that you have a budget, you will want to get more specific and clear on how you’ll get there.

When do you want to have $1,000 saved? If your goal is one month, you will have to have a target savings goal each day.

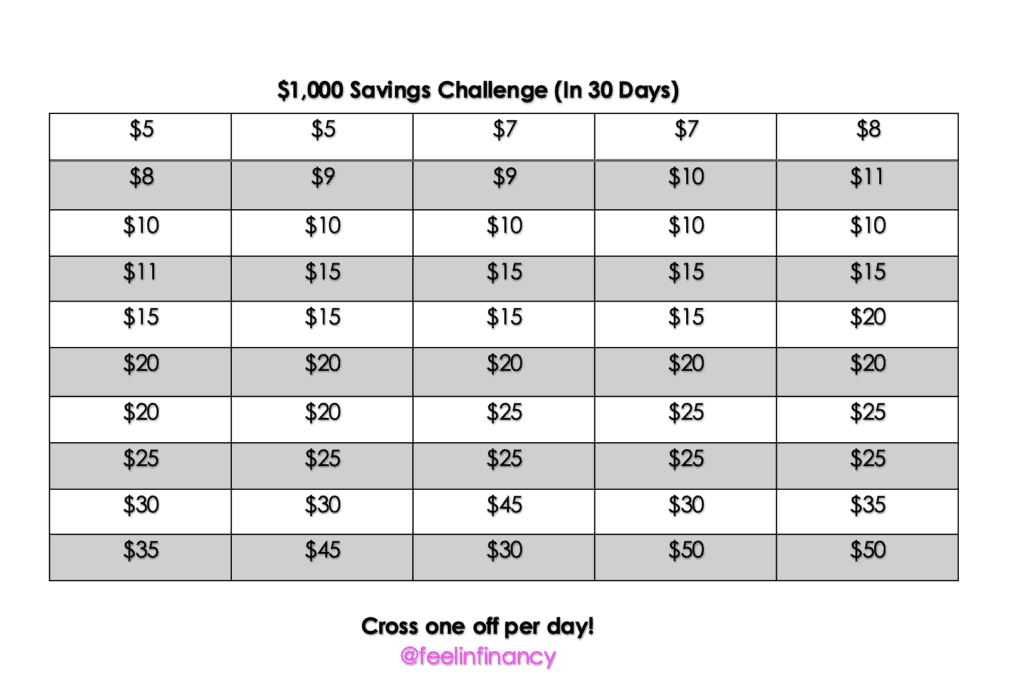

To help you out and make it a bit more fun, I’ve created a free chart to help you save $1,000 in a month.

Print out the above chart and get to crossing them off! A chart like this should help you be more excited and focused on your savings goal.

Another simple tactic that can help you achieve your roadmap plans is to tell a friend or family member your goal and have them be someone to keep you accountable.

Having an accountability partner is proven to help you better reach your goals in many parts of your life, whether the goal is finance, fitness, or health-related.

Evaluate your current income

Lastly, you should evaluate your income to understand how much you are earning per week or month.

If your paychecks are less than $1,000 in a month, you will need to adjust your savings goal to align more accurately with what you are making.

If your savings goal exceeds your income level, you could think of new ways to increase your income or earn more money through side jobs.

Although you have a certain savings goal in mind, it won’t be possible to save without an income.

Overall thoughts

If you are serious about saving $1,000, you will need to start acting like it. Some tips to help you save include creating a timeline, getting into a positive mindset, sticking to a budget, formulating an achievable roadmap, and evaluating your current income.

Surprisingly, saving money has a lot to do with your mindset and psychology. The thoughts and beliefs you have about yourself when it comes to saving money will be a massive factor in your saving success. Switching to a savings mindset will require you to develop a more optimistic attitude and mindset

Don’t worry – you don’t have to follow the above steps in any particular order. You may not even need to follow them all! The idea of this guide is to help encourage and motivate you to get into a better savings mentality.

Saving $1,000 can sound frightening, but once you realize that there are tangible ways of achieving your goal, you will hopefully be excited to keep going and make your goal even bigger!

What helps you save money? What is your why behind saving $1,000? I’d love to know!

Ashley is a finance graduate from the University of San Francisco and currently works at a financial technology startup in San Francisco that is focused on providing affordable and accessible 401(k) retirement plans to other startups and small businesses. Prior to working at a startup, she was an associate at a large private wealth management firm working with high-net-worth clients. She is born and raised in Orange County, CA, and loves spending time at the beach, in a pool, reading, and with her friends.