Do you have a retirement account called a Roth IRA? Have you ever looked at your balance and wondered, why is my Roth IRA losing money when it’s supposed to grow?

While you may know that your Roth IRA is related to your retirement savings account, it isn’t always clear what a Roth IRA is and what it does, making it confusing to know why you may be losing money in it at different periods.

An IRA stands for an individual retirement account and is one of the most commonly chosen investment vehicles for many Americans saving for future retirement.

Although we will get into specifics particularly about Roth IRA’s here, it’s good to know that an IRA can come in other forms – most commonly either traditional IRA or Roth IRA.

The most significant difference between a Traditional IRA and Roth IRA is that Roth IRA contributions are made with after-tax dollars rather than pre-tax dollars, so you won’t owe taxes when you take out your Roth IRA money.

An IRA allows you to make tax-advantages contributions to your investment account to enable you to save for your future retirement.

Why am I losing money in my Roth IRA?

It is possible to lose money in a Roth IRA.

Since a Roth IRA is an investment account, there is an inherent risk with investing in the market.

You can lose money in your Roth IRA due to market downturns, poor portfolio diversification, a lack of money and time invested into it before retirement, and early withdrawal fees. However, with a diversified portfolio and the proper amount of time to grow, a Roth IRA can be one of the best forms of investment for your future retirement.

A Roth IRA is a long-term investment vehicle that can provide significant returns over some time. Historically, Roth IRAs can deliver between 7%-10% in average annual returns by keeping your money in and continuously investing in your account over time.

Even though a Roth IRA’s primary purpose is to earn money, there are a few reasons why your Roth IRA is losing money. In this article, I will highlight four reasons why your Roth IRA can lose money but why you shouldn’t be worried over the long-term.

- Natural market downturns

- A poorly diversified portfolio

- A lack of contributions

- A lack of time

- Early withdrawals

1. Market downturns

The act of investing will always come with risk and reward.

Investment reward (increasing your money returns) will always come with some risk (the chance of losing money). However, all investment risk is not the same, and each investment has its unique level of risk depending on the type of investment.

When you have your money held in different investments, it can be easy to get freaked out by the daily news headlines such as “stocks turn lower following reports about stimulus checks” or “S&P 500 loses Friday gain.”

Although it’s easy to get lost in these headlines, I think that the best thing you can do when it comes to long-term investments like a Roth IRA is to ignore these news statements and focus on the bigger idea while keeping patient and concentrated on your long-term goal.

“Sustained declines are bound to make investors uncomfortable while they’re happening. But there are steps you can take to put times like this in perspective — and perhaps even potentially benefit.”

Nick Giorgi, investment strategist, Chief Investment Office for

Merrill and Bank of America Private Bank

“To optimize one’s potential over the long term, what’s crucial is time in the market, not market timing.”

Niladri Mukherjee, head of CIO Portfolio Strategy in the Chief Investment Officer for Merrill and Bank of America Private Bank.

When the market randomly drops, it can be easy to want to take out all of your money and feel safe. But the best solution to losing money in your Roth IRA is to keep invested, ride it out, and keep a positive perspective.

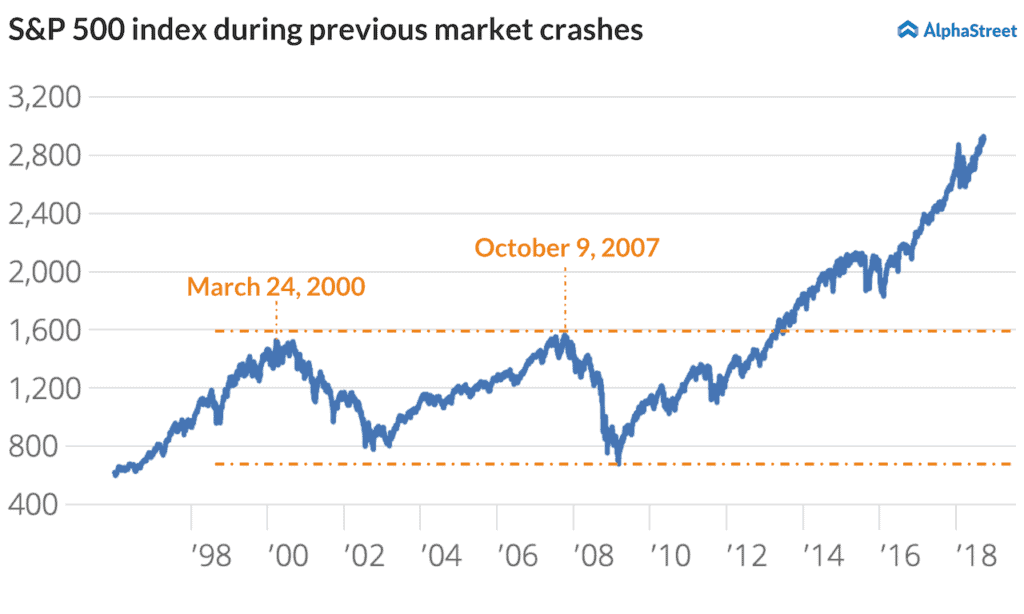

See below to see how previous market crashes have corrected themselves in the long-term.

2. A poorly diversified portfolio

The second reason your Roth IRA may be losing money maybe is due to a poorly diversified portfolio.

A Roth IRA isn’t always made up of the same investment and can vary from person to person. One of the most common ways Roth IRAs are allocated is through mutual funds, exchange-traded funds (ETFs), or target-date funds (TDFs).

A mutual fund is a pooled investment fund that includes different types of stocks, bonds, or short-term debt to make up your overall portfolio.

ETFs or exchange-traded funds are similar to mutual funds because they are a pooled group of investment assets. However, ETFs are different because they are traded on a national stock exchange and can track an index like the S&P 500 index.

A target-date fund (TDF) is another common type of retirement investment with a diverse mix of assets. Over time as you become older and closer to retirement age, a TDF will automatically shift or change as the fund approaches the “target-date.” A target-date fund looks something like “XYZ 2045,” which indicates that the person plans on a 2045 year of retirement.

Keep in mind that a well-diversified portfolio is a variety of investments that is something other than the large U.S companies that everyone knows of.

The best growth starts with a well-diversified portfolio.

3. A lack of contribution

The third common reason your Roth IRA may be losing money is due to a lack of contributions or money invested over a consistent time frame.

If you want to learn more about what compound interest is and how it works, check out my article titled, “Why Compound Interest Matters and Why it Literally Pays to Start Saving Early.”

To sum up the article, compound interest allows your money to grow over time and is crucial to making your money work for you.

Although time is vital, there must also be a particular percentage or contribution amount that you commit to investing in per month. Each contribution you make allows for a more significant opportunity to grow.

With a consistent contribution schedule, compound interest can better do its job to make your money grow.

There are a few contribution guidelines for both Traditional and Roth IRAs that must be followed. Below are the contribution guidelines that are defined by the IRS.

The most you can contribute to all of your traditional and Roth IRAs is the smaller of:

- For 2019, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or

- your taxable compensation for the year.

- For 2020, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or

- your taxable compensation for the year.

- For 2021, $6,000, or $7,000 if you’re age 50 or older by the end of the year; or

- your taxable compensation for the year.

Generally, the average contribution rate is somewhere between 6% and 10%. Of course, the higher your contribution rate is better, but if you can’t afford to do that, a small amount is much better than nothing!

4. A lack of time invested

Your Roth IRA could potentially lose money from the lack of time invested.

Think of your IRA as a plant starting as a little seed – with the proper sunlight and water, and you should begin to see new leaves, signifying growth.

Time is the equivalent to sunshine and water – time is essential for growth in your Roth IRA or any investment account, for that matter.

It may be obvious, but time is money.

There will be a noticeable difference in your egg nest balance when you retire if you started investing in your Roth IRA at age 25 versus 45, even if the contributions are relatively small.

4. Early withdrawals

The last most common reason your Roth IRA can lose money is early withdrawals or taking money out of your account before retirement age.

Your Roth IRA is supposed to be a long-term investment vehicle prepping for your retirement, which is most likely very far in the future.

Since a Roth IRA is a future investment account, you are encouraged to keep your money invested for quite a while.

Sometimes in life, there is no other choice other than to withdraw money from your Roth IRA, but if you don’t need to do it, you shouldn’t.

Early withdrawals are one of the worst things you could do due to the early withdrawal penalty.

If you decide to withdraw money from your Roth IRA early (before age 59 ½), a 10% tax penalty will apply.

However, the IRS has a few exceptions to the early-withdrawal rule, including disability, death, education, medical expenses, etc.

Early withdrawals sound like a good thing but can create a significant loss in your Roth IRA due to the 10% penalty and should be avoided if not necessary.

What should I do if my Roth IRA loses money?

If your Roth IRA loses money, it’s essential to keep things in perspective with a forward-thinking attitude.

Remember that your Roth IRA is a long-term investment vehicle, made to compound over time.

Instead of panicking to pull out your money every time your account dips, try to think about your future self enjoying a large amount of retirement money, as this will keep you going.

Should I pull money out from my Roth IRA to pay for debt?

Generally speaking, it is not smart to pull out money from your IRA until you retire.

It may sound nice to take your Roth IRA money out since you’ve already paid taxes on it, but the 10% withdrawal penalty will still apply, as debt is not an IRS exception to the rule and could result in more harm than good.

Can I take a hardship withdrawal to pay off credit card debt?

A hardship withdrawal is a withdrawal of money from your account because of an immediate and heavy financial need.

When credit card debt feels overwhelming, you may want to use your Roth IRA funds to pay it down. However, credit card debt is not a good reason to take out your hard-working IRA funds and won’t qualify as a hardship.

What is the 5-year rule for Roth IRAs?

Not to be confused with the 10% withdrawal penalty, the 5-year rule states that you must wait 5 years to withdraw your Roth IRA’s earnings since your first contribution.

Since it might be tempting to withdraw investment earnings, the IRS’s 5-year rule is in place.

According to the IRS, Roth IRA distributions must be taken in this order:

- Contributions

- Conversions or rollover contributions

- Earnings on investments

Final thoughts

A Roth IRA is one of the best forms of investments that can lead to a very happy and comfortable retirement.

Although your Roth IRA’s balance will fluctuate over the years, it’s important to keep a long-term and steady mindset to get the most out of your investment.

If your Roth IRA is losing money, you should remember that investment loss is normal and will happen over time.

If you are still worried, I suggest you review your portfolio with a financial advisor to make sure it is well diversified and heading in the right direction in coordination with your age.

Lastly, be sure to thank yourself for thinking about your retirement and making a conscious effort to plan for your future!

Starting an IRA in itself is a big accomplishment that you should be proud of.

Ashley is a finance graduate from the University of San Francisco and currently works at a financial technology startup in San Francisco that is focused on providing affordable and accessible 401(k) retirement plans to other startups and small businesses. Prior to working at a startup, she was an associate at a large private wealth management firm working with high-net-worth clients. She is born and raised in Orange County, CA, and loves spending time at the beach, in a pool, reading, and with her friends.