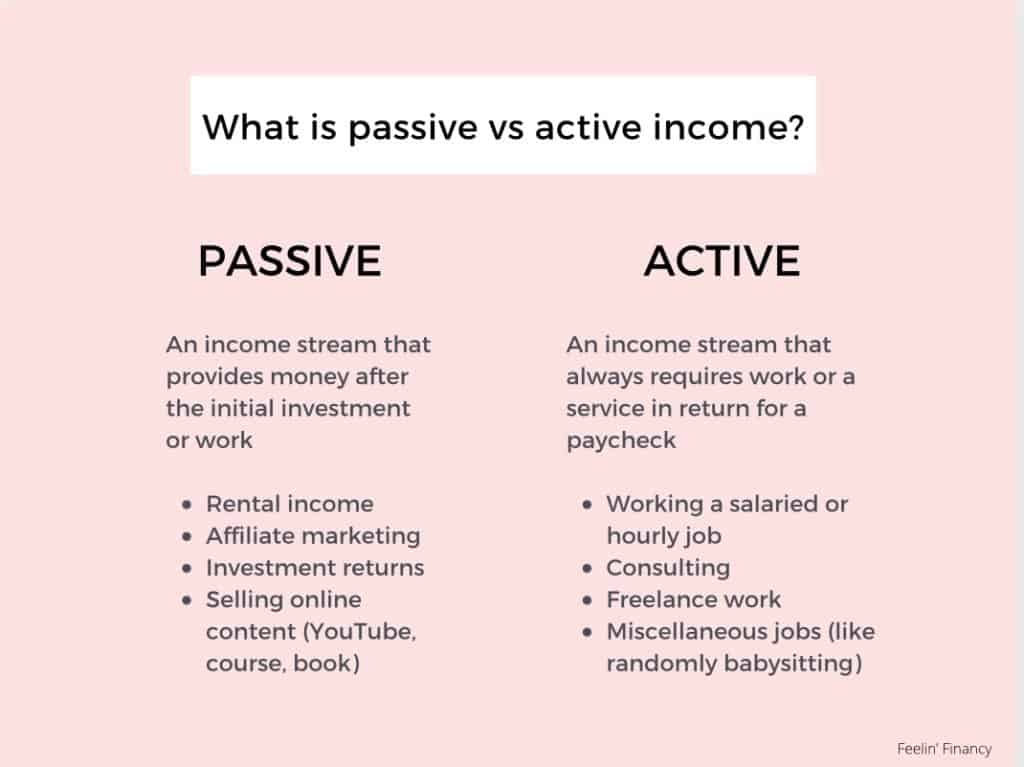

You may have heard of income being either passive or active.

But what does passive and active income mean?

This article will discuss the key differences of passive versus active income, provide some examples of each, and highlight why you may prefer to create passive income streams rather than active income streams.

Passive income is an income stream that continues to make you money long after the initial work or investment. Passive income requires work initially but generally ends up producing money for you long after you stop working on it.

Active income is an income stream that always requires continuous work or service to generate an income. Active income always involves work. You can think of active income as services performed for a paycheck, such as a part-time job.

Let’s look at some examples of passive income and what each means. Below are four great examples of passive income:

- Rental income

- Affiliate marketing

- Investment returns

- Create content online (youtube, course, book)

Before we get into each example, why would you want passive income?

Passive income can be an excellent way to build your long-term financial goals. Passive income can be a great way to save for future events, achieve financial freedom, create generational wealth for your family, and give to others down the road.

Remember that passive income is money that actively works for you after putting the initial work in. Passive money is money earned from assets that you control.

1. Rental income

Rental income or rental property is one of the best ways of creating a passive income source.

Investing in rental properties can be a great way to diversify your portfolio of assets and supplement your income passively.

Creating passive income through investment properties can take a significant amount of upfront work and capital before you start making passive money from it.

If you want to create rental income, you’ll have to do the proper research before to ensure that you have the capital and time necessary to own rental property.

There are two main types of real estate investing: either a direct purchase of property or indirect purchase of a property.

Direct purchase of property means that you directly buy and own a physical building and prepare to rent it out to others, making you the landlord.

An indirect purchase of property is a type of investment that doesn’t require you to own physical property. The most common type of indirect real estate investment is a REIT, or real estate investment trust, that acts similarly to a stock.

REIT shareholders can earn a part of the income that the real estate investment produces without buying, managing, or renting out the property.

REIT shareholders can earn a part of the income that the real estate investment produces without buying, managing, or renting out the property.

In return for owning REITs, the company pays its shareholders a dividend (or part of its earnings) from its property income to shareholders. I will discuss dividend-paying stocks a bit more later on in the article.

REITs invest in real estate types, including commercial property, apartment buildings, complexes, medical towers, and more.

Although I don’t own direct income properties yet, it is one of my future goals because real estate can be a sizeable passive income source. However, I do own REITs (real estate investment trusts), an easier way to access and own income property.

If you want to start investing in indirect real estate, I recommend you check out Fundrise, a simple and easy platform to invest in real estate funds like REITs.

2. Affiliate marketing

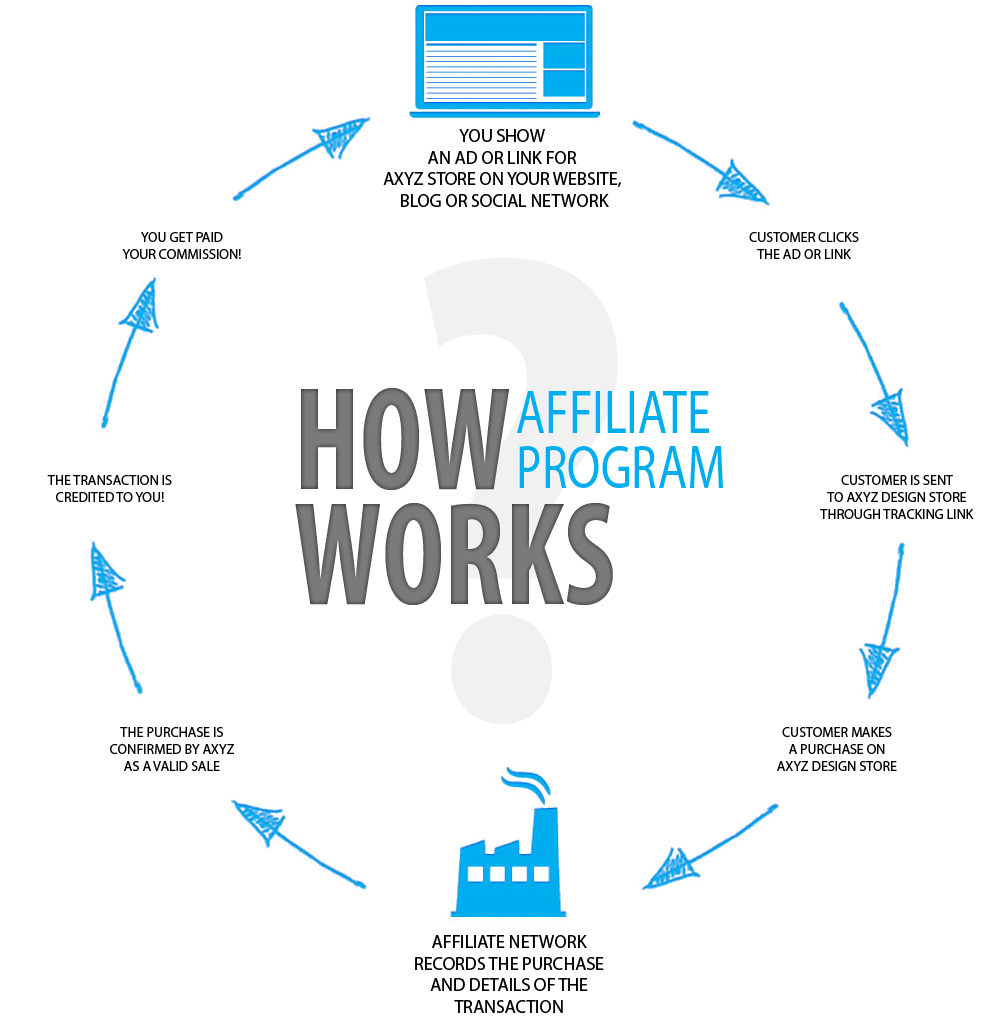

Affiliate marketing can come in many forms but is simply a marketing process to earn money via commission for advertising other company’s products.

Most affiliate marketing gets promoted through links or advertisements about a particular product, which entices readers.

If you are an affiliate marketer, the hope is that your audience or viewers see the affiliate link or ad through your platform. Most times, you, as an affiliate marketer, will have a unique link to the item you are discussing. If your audience clicks on that unique link, you can earn a commission through your marketing efforts.

For example, suppose I searched online “best affordable therapy platforms” and came across a blog that discusses a therapy platform I like. In that case, there could be some affiliate link attached to the blog. If I decided to click the link advertising the therapy platform, signed up, and booked a session, that person who created the initial link could earn money on it.

It’s a win-win situation for both people!

Here is an excellent example of how affiliate programs generally work and the typical cycle:

3. Investment returns

One of the best types of passive income you can make is money from your investments.

A very common way that you can earn money on your investments is through dividend investing. If you own a stock that pays out a dividend, also known as dividend-paying stock, you could be making passive income on a company just by holding a share.

For example, if you owned a dividend-paying stock like Disney (a company that has consistently paid dividends for years), you would be earning passive income on Disney as they continue to grow and generate revenue. And you would make money through them just by holding the stock!

You can think of companies’ dividend earnings as a little “thank you for investing in us” from the company. However, not every stock pays out dividends. Dividends usually get paid out by mature companies that have been around for a while.

Another great way of earning passive income through investment return is through index investing. An index fund is a pooled group of stocks or bonds that mimics a particular index, like the S&P 500 index.

Since an index fund tracks an index (in it’s name!), they are passively managed and go to work for you without you having to worry. Index funds offer a very hands-off approach, so you don’t have to always worry about them.

Index funds are also generally very low in cost, which makes them affordable for most people. If you want to learn more about beginner investing, read my article titled, “5 Great Reasons To Invest Early and How to Without Risking It All.”

4. Create content online

Another great form of passive income is self-created content, including creating and monetizing a YouTube channel or TikTok channel, building an online course, or writing a book).

Creating content is a very popular activity in today’s day and age and can make a good stream of passive income if done correctly.

If you have something you want to teach with the world or a skill you are good at, you should think about creating content that can lead to passive income.

Youtube and TikTok

I’m not a Youtuber, but I know that YouTubers can make a decent passive income stream if they do it right.

Some ways to make money from Youtube include partnership ads, selling products, or working with brands as an influencer or affiliate marketer.

TikTok works a similar way as Youtube – it’s all about views and promotion. TikTok influences create good content and then get paid through various methods, including company brand partnerships and influencer campaigns

If you are interested in learning more about Youtube and TikTok, there are tons of great videos and blogs online to start and build each.

Write a book

Writing and publishing a book is another excellent form of passive income if done right. Books can come in different shapes, including e-books. A book can either be self-published or with a book publisher.

Once a book is published, you can start promoting and selling your book everywhere. Most authors will work hard to write and publish a book initially but will enjoy the long-term benefits of passive income later on.

Create an online course

By creating and selling an online course, you will be able to generate passive income for years after you make it.

Yes, it will take resources and time to create a course, but you can start promoting and selling it online once it is completed, like a book.

If you don’t want to self promote your course, there are tons of great platforms that you can help sell your course, like Udemy.

Passive income means your money is working for you. Although passive income generally requires more upfront work, it will end up working in your favor later on.

Now that you have a good idea of what passive income is, we will dive into the opposite of passive income, or what’s known as active income.

Again, active income will always require continuous work to get paid. Active income is money earned in exchange for a service, job, or specific effort. Some examples of active income include:

- Salaried or hourly job

- Consulting

- Freelancing

- Miscellaneous jobs

1. Working a salaried or hourly job

If you work a part-time or full-time job and either get paid hourly or salaried, you earn active income. Depending on your job, you will get paid a particular amount of money for the time and hours you put into work.

2. Consulting

Like working a salaried or hourly job, consulting requires you to put in a specific amount of time or energy into a project in return for income. Consulting can come in many different forms, such as coaching individual clients or working at a large consulting firm.

3. Freelancing

Freelancing is an individual who does different types of jobs and generally does not have a defined schedule or a company supporting them.

Freelancing can be a great way to make active income without being tied down to a company or schedule. There are tons of freelancing jobs that can be done remotely or in-person, depending on the job.

Freelance jobs range from freelance writing, social media, editing, teaching, and tutoring.

4. Miscellaneous jobs

Like freelancing, active income can also be earned from other miscellaneous jobs that don’t have a recurring pattern, like babysitting or dog-walking.

Any job that requires an act of service in exchange for pay is classified as active income.

Closing thoughts

Overall, passive income is the best type of income because it can create an income stream for you over time without continuously putting in the effort.

With passive income, you can have more free time and flexibility compared to active income activities. Once you do the initial work with passive income, you can quite literally make money overnight.

However, active income is still a significant income stream and is the most common type of income. Most of the time, to start making passive income, you’ll need first to have a form of active income.

It’s not wrong to only have an active income, but combining both can lead to more comfortable financial independence later on in life. It’s always better to make your money work for you when you can!

Other related questions:

Which type of income is better?

Passive income is the best type of income because passive income generates income long after the work is completed.

If you think about it, wouldn’t you prefer to put in the work for something early on and let it continuously make money for you over time?

How is passive income taxed?

Passive income will still always be taxed, depending on the type of passive income generated.

The IRS defines passive income as all income from passive activities that includes any gain from disposition of a passive activity.

Without getting into the tax code, passive income will be taxed based on the tax rate, how long an investment is held, and the type of profit made.

If you are interested in learning more about the tax on passive income, I think this blog provides a good explanation.

What is passive income versus residual income?

The terms passive income and residual income may sound like similar terms but have two different meanings. In personal finance, passive income is income earned passively without continuous effort.

Residual income is another form of income but is defined as an individual’s income level after all debts and expenses are paid.

An individual’s residual income level is generally used to calculate an individual’s creditworthiness if they are looking to borrow.

I hope you learned more about the differences between passive and active income and how each works!

Thank you for reading.

Ashley is a finance graduate from the University of San Francisco and currently works at a financial technology startup in San Francisco that is focused on providing affordable and accessible 401(k) retirement plans to other startups and small businesses. Prior to working at a startup, she was an associate at a large private wealth management firm working with high-net-worth clients. She is born and raised in Orange County, CA, and loves spending time at the beach, in a pool, reading, and with her friends.

[…] real estate can be a great form of passive income, it is not an ideal income source if you need to have the money in a short time frame. It can take […]