As someone who works in the fintech industry, I commonly get the question what exactly does the word fintech even mean?

The term fintech is just a combination of the two words “finance” and “technology.” The goal of most fintech companies is to innovate and streamline the financial services industry to make it friendlier, more affordable, and accessible to consumers.

Fintech companies refer to all types of companies, from startups to large technology firms. When most people talk about fintech, they speak of a product or tool that is seeking to improve the financial services industry.

According to Investopedia, the 21st-century term was first only applied to financial institutions. Since then, the name has evolved to much broader sectors, including nonprofit, education, and fundraising. Additionally, Fintech often includes other parts of finance, including cryptocurrencies like bitcoin. While the concept of fintech is relatively new, it is a booming market that analysts expect to grow. The fintech market was valued at $127.66 billion in 2018 and is forecasted to grow to $309.98 billion by 2022. Now that is a booming industry to be in!

There are a ton of new and emerging fintech companies as of 2020. And the list is only going to continue to grow. Some well-known fintech companies that people know and use include:

- Venmo (digital payments…and how we all pay our friends for things)

- Square (makes payments easy for all sized businesses)

- SoFi (provides affordable loan financing)

- Coinbase (makes it easy to buy, sell, and store cryptocurrency)

- Chime (friendly banking with no hidden-fees)

- Acorns (specializes in Robo-advising and investing)

- Robinhood (commission-free investments, making your money work harder)

- Human Interest (an affordable and straightforward fully-bundled 401(k) solution for small-medium sized businesses)

- Affirm (provides transparent, short-term loans for purchases)

- Carta (equity management solution for all)

While this list only has a couple of significant fintech companies, they all have a similar idea: to make the financial services industry better.

Fintech can be in the form of payments, investing, and banking. Overall, fintech is an exciting and growing industry that is making a big difference in the financial services world.

Why is Fintech so popular today?

As technology continues to streamline mundane and archaic ways of doing things in daily life, it has also influenced the finance industry. Fintech companies are continuing to transform the way we pay, bank, and invest through smarter and more efficient technology.

With the growing amount of fintech companies, finance can reach a broader spectrum of consumers that enjoy easy, simpler, and faster ways of doing things relating to personal finance.

Forbes notes that fintechs allows greater access to capital for all types of people, including underserved communities such as small business owners and those who identify as a minority group. Providing a fairer playing field allows more people to access financial technology.

The Fintech Ecosystem

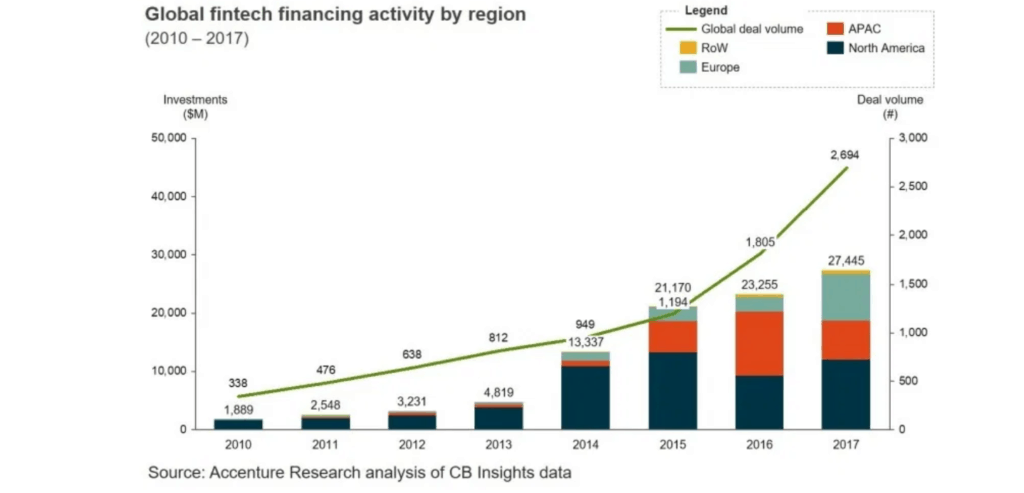

Nearly US$100 Billion has Flowed into fintech ventures since 2010.

What do you think about fintech companies? Have you heard of the term before or is it new to you?

Ashley is a finance graduate from the University of San Francisco and currently works at a financial technology startup in San Francisco that is focused on providing affordable and accessible 401(k) retirement plans to other startups and small businesses. Prior to working at a startup, she was an associate at a large private wealth management firm working with high-net-worth clients. She is born and raised in Orange County, CA, and loves spending time at the beach, in a pool, reading, and with her friends.