If you’ve ever listened to financial news, you probably have heard of something called the “bid” and “ask” price when talking about trading stocks.

If you haven’t heard of the bid and ask price, I will help explain what these weird words mean in financial terms so that when you do listen or read financial news, you will know what it means!

The stock market is full of many traders that either want to buy a stock or sell a stock. Both buyers and sellers create every transaction in the stock market.

Two main prices involved when talking about investing in financial instruments such as a stock are the bid and ask price.

What is a bid and ask price?

The bid price is the highest price a buyer is willing to pay for a stock (bid = buyer)

The ask price is the lowest price a seller is willing to sell for that same stock (ask = seller)

Here is an example of a bid and ask price in words:

On November 20, 2018, Microsoft had an ask of $265.53 and a bid of $265.50 on the NASDAQ stock exchange. This means that the lowest price sellers wanted to sell their stock for was $265.53, while the highest price a buyer was willing to pay was $265.50. Bid and ask prices usually move continuously throughout the trading day.

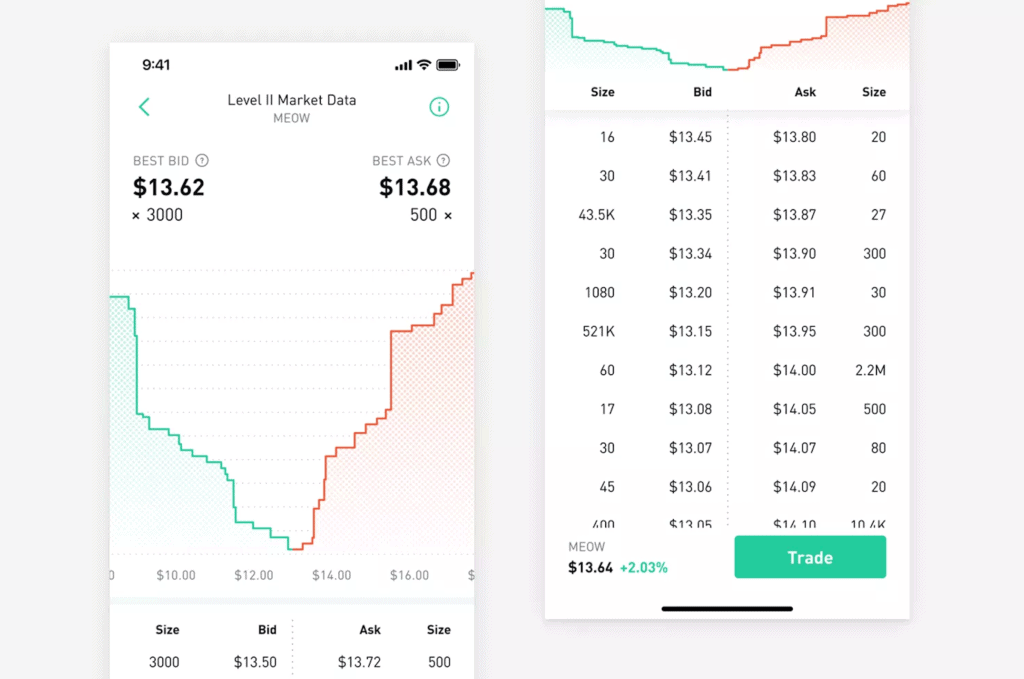

Here is an example of a bid and ask price in image form:

How to read the bid and ask price

If you look at the above image, you’ll notice a few different types of numbers for this stock, MEOW.

The numbers next to the bid and ask quotes let traders know the current price of buying or selling a particular asset.

In this type of scenario, the current price shown is the price that you could immediately buy or sell this stock MEOW.

The best bid price (or buy price) for MEOW is $13.62 (x3,000), and the best ask (or sell price) is $13.68 (x500).

The numbers following the bid and ask price represent the number of assets available at those prices. The bid and ask size, or quantity, is notated by the “X” which stands for “times.”

What does the spread or bid-ask spread mean?

In finance, the spread is just the difference between two prices, rates, or yields. A few types of spreads include the bid-ask spread, forex spreads, and futures spreads.

To make it simple, we will focus on bid-ask spreads for this concept of the bid and ask price. The term bid-ask spread is another word you should know when talking about the bid and ask price.

A spread between the bid and ask price is just the difference between the two prices (the bid and ask price). This spread is most commonly known as the Bid-Ask spread.

In the above example of MEOW, the spread would be calculated by $13.68 minus $13.62, which would be 0.06 cents.

What is a market maker in the stock market?

Stock exchanges, like the Nasdaq, coordinate with brokers and stock specialists to establish a stock’s buying and selling price. A broker is the same word as a stock specialist or market maker. A market maker is the most commonly used term used to describe this person.

A market maker is a firm or individual that provides bid and ask prices in tandem with a security (or stock) while engaging in both sides of the market. A market maker seeks to profit off the spread difference. A market maker’s primary purpose to keep liquidity in the market.

A market maker is a firm or individual that is ready to buy or sell a stock at publicly quoted prices. Market makers earn money on the difference between this bid and the ask price.

What price is usually higher?

The ask price is usually the higher price when comparing bid-ask prices. The ask price is the lowest price at which a market maker will sell a specific stock. The ask price usually will always be higher than the bid price.

What are the most common types of market orders?

The most common types of orders are market orders, limit orders, and stop-loss orders.

Market order

A market order is an order to buy a stock immediately. Although a market order attempts to execute near the current bid or ask price, there is no guarantee on any price.

Limit order

A limit order is an order to buy or sell a stock at a specific price or better.

Ex: An investor named Sarah wants to buy XYZ stock for no more than $20. Since Sarah doesn’t want to pay more than $20, Sarah could submit a limit order to execute if XYZ’s price is $20 or lower. If XYZ stock drops to $19, a limit order will be executed.

A limit order represents the most you are willing to pay for a stock. In Sarah’s case, the most she was willing to pay was $20.

Stop order or stop-loss order

A stop-loss order is an order to buy or sell a stock once the price reaches a specific price or stop price. Once the stop order is reached, the order becomes a market order.

What are regular hours and market hours?

U.S stock market hours (like the New York Stock Exchange) operate on particular hours and is open from 9:30 am to 4 pm EST unless there is a stock market holiday.

Stock market hours differ for Europe, Asia, and Canada so if you don’t live in the United States or want to learn more about other country’s market hours, check out Investopedia.

What is liquidity, and how does it relate to bid and ask prices?

If you want to learn more about general liquidity in terms of assets and investments, check out my article titled, “What Are Liquid Investments? Explained with Clear Examples.” Liquidity also is essential when it comes to buying and selling stocks.

When talking about buying and selling stocks, liquidity is often caused by a large influx of orders to buy and sell in the stock market.

One of the best ways to analyze the liquidity of a stock is in the spread difference. The bid-ask spread, or the difference between the bid and ask price, is also a liquidity measure.

Liquidity is measured in the bid-ask spread. The closer the bid and ask price are to one another, the more liquidity in the stock. The bid and ask spread’s closeness means that the price is closer to the market value price.

A smaller spread, or slight price difference, means greater liquidity in the stock with plenty of trading volume. Since there is plenty of volume to trade, there is less risk on the investor. A small spread is known as a “narrow” spread.

A narrow spread indicates that the bid and ask price are very close in price. With a narrow spread comes lots of liquidity, making it easier for investors to enter or exit stock positions.

Companies that have narrow spreads are generally blue-chip companies. Blue-chip companies usually have been around for some time, are well recognized, and are financially stable. An excellent example of a blue-chip company is Coca-Cola.

On the opposite, a large spread, or large price difference, means less liquidity in the stock. Since there is low trading volume, there is a greater risk on the investor. A large spread is known as a “wide” spread.

A wide spread indicates that the bid and ask price are too far apart from each other. With a wide spread comes illiquidity, which means it can take lots of time or money to enter and exit the position.

A wide or large spread also indicates market turmoil or greater volatility in the stock price. Market volatility widens the spread because the market is unpredictable and uncertain. With a wide spread, there is a lack of trade volume, making it harder to buy and sell near the market value.

If there is a wide spread, there is not much trading going on, leaving greater potential of getting stuck with the stock.

What is the current price?

The current price is the market value price and is the actual selling price of a stock.

During market hours, that price is always fluctuating based on the price the asset was last bought or sold for.

If you wonder why the stock prices are always fluctuating, it is because of the law of supply and demand.

If there is low availability of a product but high demand, prices will generally increase. The opposite also applies – high availability of a product and low demand means prices will naturally decrease.

The law of supply and demand also governs the individual stocks that make up the entire stock market.

“The price of ability does not depend on merit but on supply and demand”

George Bernard Shaw

Final thoughts

The bid and ask price are two fundamental terms when discussing investing. There will always be buyers and sellers in the market, so it is crucial to understand what these terms are when talking about stock trading.

I hope that the terms bid and ask aren’t so scary to you anymore and that you now know what they mean.

Thank you for reading!

Ashley is a finance graduate from the University of San Francisco and currently works at a financial technology startup in San Francisco that is focused on providing affordable and accessible 401(k) retirement plans to other startups and small businesses. Prior to working at a startup, she was an associate at a large private wealth management firm working with high-net-worth clients. She is born and raised in Orange County, CA, and loves spending time at the beach, in a pool, reading, and with her friends.