A debit card is a great way to pay for items without carrying around cash or a checkbook. Debit cards have reinvented the way humans pay and have made transactions much quicker and simpler.

Are you wondering what to do when your debit card expires?

Debit cards have an expiration date mainly to protect against fraud. Typically, a debit card will expire every two to three years. If your debit card expires, your bank will automatically send you a new card in the same month that it’s set to expire to ensure that you can continue using it for future purchases.

This article will cover all things debit card related, including what to do when your debit card expires.

Most banks and credit unions will automatically send you a new debit card if yours is close to expiring, but to get a better idea, let’s look at what the four largest banks do when a debit card expires to see how this process works.

This article will also explore the top 5 things to do if your debit card expires and best practices regarding your account.

First, let’s explore the process of issuing new debit cards when one expires, according to the top four banks. The top four largest banks include JPMorgan Chase & Co, Bank of America, Wells Fargo, and Citigroup.

Chase

If you bank with Chase, and your debit card is about to expire, Chase will automatically send you a new card. Chase states that they will send you a new card during the same month that your current card is supposed to expire.

If you haven’t received a new debit card during your expiration month, Chase suggests that you call the number listed on your account statement to get more help.

Bank of America

Like Chase, Bank of America will also automatically replace an expired debit card without a fee.

You shouldn’t have to call to ask for an expired debit card replacement, but if there happens to be an issue with receiving your new debit card within the month of your current card’s expiration, call the help number on the back of your card to speak with a representative.

Wells Fargo

Wells Fargo will also automatically send you a replacement debit card

usually one week before your current debit card expires.

You can find more related debit card questions regarding Wells Fargo here. Another fun fact about Wells Fargo is that they will let you customize your debit card, whether you want that to be a picture of your dog or your favorite beach (my debit card is a picture of Laguna Beach, one of my favorite spots!)

You can learn more about customizing your debit card for free here. If you have Wells Fargo, you should take advantage of this cool feature.

Citi

If you bank with Citi, you will automatically receive a new debit card once yours expires. Citi states that you should receive your new debit card a few weeks before your current card expires.

Your current card is valid until the last day on the expiration date (date is embedded on the card).

Debit card expires with any other bank or credit union

If you bank with any other bank or credit union, the best way to check their expired debit card process is by checking their direct website or calling the main help line.

Next, we will cover the top 5 things to do when your debit card expires and what to do once you receive a new card.

- Confirm your card’s expiration date

- Research or call your bank or credit union for next steps and process on receiving your new card

- Activate your new card

- Dispose of your old debit card

- Update all your accounts with your unique number

1. Confirm your debit card’s expiration date

If your card is about to expire or recently expired, you’ll want to keep track of your current card’s expiration date.

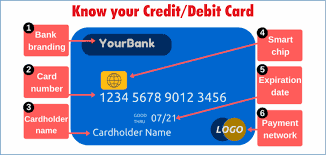

The expiration date is found on the physical card and is written like “xx/xx” for the month and year. If your card expires on 02/22, or until February 2022, you’ll be able to use your card until the last day in February.

2. Research or call your bank or credit union to confirm the process of receiving a new card

If your debit card recently expired or is about to expire, it is best to confirm with your bank what will happen next.

Most banks will ensure that you receive your new debit card within the month of expiration, but it can be easier to figure that out by researching their website or calling your bank directly.

If there is an issue with receiving your new debit card, call the number on your card’s back to sort through the details. Sometimes, the fix can be as simple as updating your information to a new address.

3. Activate your new debit card

Once you receive your new debit card, usually via mail, the best thing to do is to activate your card right away.

Usually, there is a little activation sticker on the debit card with a phone number that you can call to activate it. If there is no sticker, a phone number is listed on the card that will act in the same way. Once you call that number, your card should instantly be activated and be ready to use. You may have to recreate your four-digit PIN to finalize activation.

Another way to activate your new card is by directly going into your bank to speak with a representative. Although card activation can be done over the phone, a banking representative can also assist you with other things regarding your bank account.

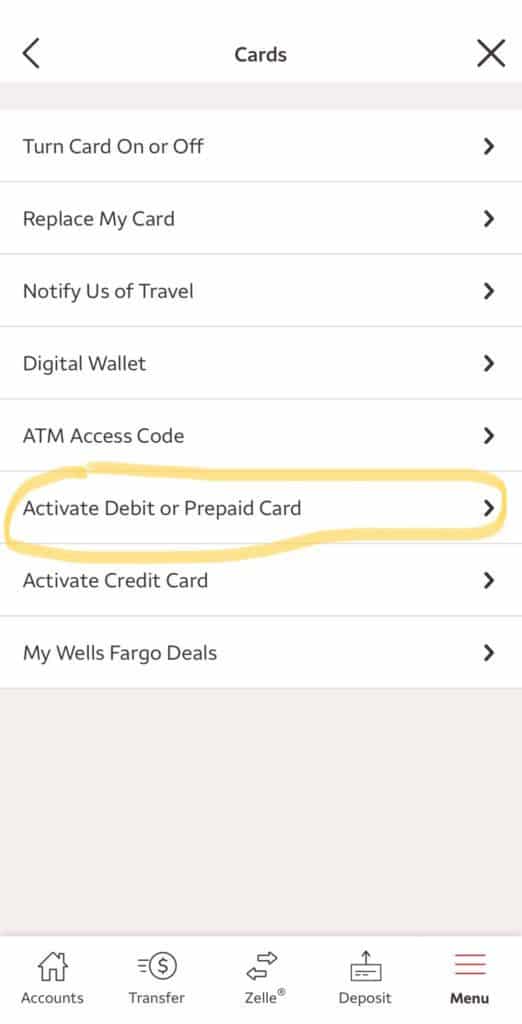

You can also activate your new card through your bank’s online application. If you have your bank’s mobile application downloaded, this way can be straightforward and effective. In the mobile app, search for something along the debit card activation lines to read through the process.

Lastly, you can activate your new card by merely making a purchase (assuming that you already have a PIN established). An excellent way to activate your debit card is by going to your local grocery store or gas station and using your card there.

4. Dispose of your old debit card

Once you receive and activate your new debit card, you should dispose of your old card as soon as possible.

Instead of just throwing away your old card in the trash, you will need to destroy your old card to ensure that your protected information stays safe.

The best way to destroy your old debit card is by cutting your card with a strong pair of scissors horizontally in strips, ensuring that the account number, security code, and magnetic strip are unable to be read. If your old debit card has a chip reader, it is also best practice to make sure that the chip is no longer intact or attached to the card.

Once you tear up your old debit card, be sure to throw all the small pieces away in different trash cans so that the parts can’t be stitched back together somehow.

5. Update all of your accounts with your new debit card number

Lastly, you should go through all of your accounts to update each account with your new debit card and correct expiration date.

Although your checking and routing number don’t change when you get a new debit card, you will have to enter your new debit card details, as the expiration date and CVV changes.

A lot of times, your debit card may be connected to a recurring subscription. An example of a recurring payment would be something like Netflix, as you get charged a subscription fee per month on the same card. It wouldn’t be good if you accidentally missed a payment that you were expecting to pay for, so it’s best to review which card is linked to each account.

Other apps like Venmo, for example, may also ask you to update your account with the new debit card details in order to use.

Other related questions

What is the history of a debit card?

Today, the debit card is one of the most widely used forms of electronic payment. A debit card is a powerful little plastic card used to make secure and easy purchases.

Debit cards work by withdrawing funds directly out of someone’s bank account at the sale or point of sale (POS). Withdrawn funds come out particularly of their checking account.

The debit card’s history is quite interesting. The debit card is dated back to 1966 and was first used by the Bank of Delaware.

Can you use an expired debit card?

No, you cannot use an expired debit card.

A debit card purposely expires to help protect you from banking fraud and is in place for your safety.

Once you get your new debit card, you will be able to continue to use it like normal and won’t have to worry about the expiration date again for a couple of years.

Since your debit card links to your checking account, you will no longer be able to use it at an ATM, store, or online shop as long as it is expired.

Why do debit cards expire?

Debit cards expire to protect your financial information and to ensure that your account stays safe.

A debit card’s expiration date also confirms that your account is still active and valid and can be used. As time goes on, it is also normal to experience card damage from use, so a new card is great to have after a few years.

Will my debit card number change when I get a new card?

When you get a new debit card, the sixteen number digits on the card will not change.

The only numbers that will change on the card are the CVV and expiration date. Since the CVV and expiration date change, you will need to update all your accounts with the new card details.

Closing thoughts

In this article, I hope you learned a little bit more on why debit cards expire, how to contact your bank to learn more about your card’s expiration date, and what to do when you debit card expires.

Ashley is a finance graduate from the University of San Francisco and currently works at a financial technology startup in San Francisco that is focused on providing affordable and accessible 401(k) retirement plans to other startups and small businesses. Prior to working at a startup, she was an associate at a large private wealth management firm working with high-net-worth clients. She is born and raised in Orange County, CA, and loves spending time at the beach, in a pool, reading, and with her friends.