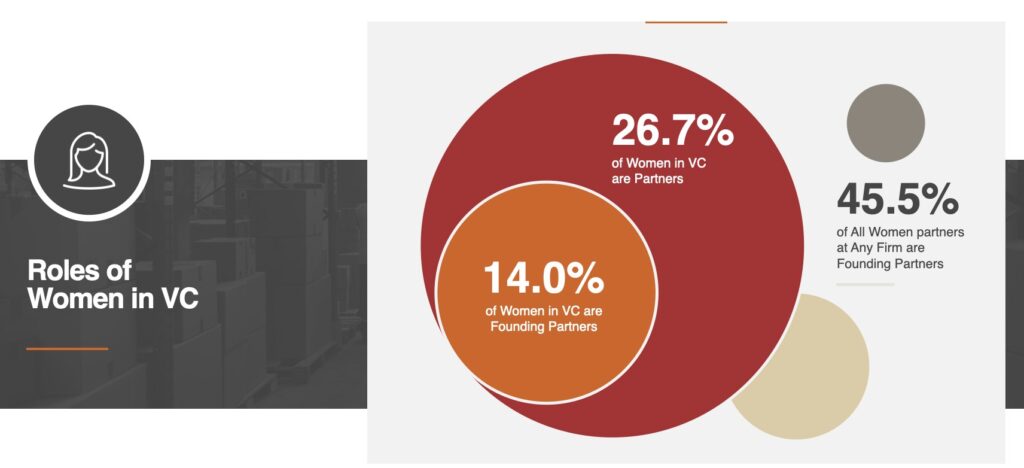

Venture capital is a male-dominated industry and bias, whether conscious or subconscious. Harvard study showed that 70% of VC investors preferred pitches presented by male entrepreneurs over those presented by female entrepreneurs, even when the pitches were identical in nature.