“You want your money to hang out with these two best friends: time and compound interest.”

Chris Hogan

Why is compound interest important for saving money?

You probably hear all the time that it is better to start saving money early on in your life rather than later. Although most people have heard this advice before, what is the science behind the theory of compound interest?

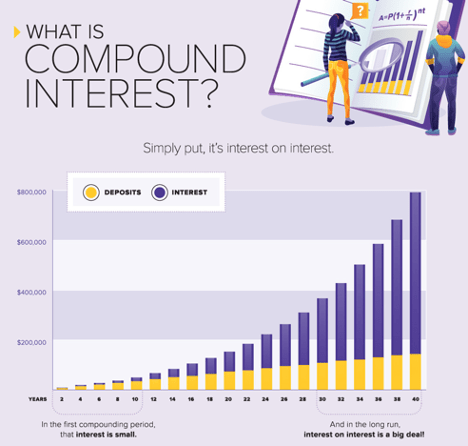

Simply put, compound interest (in saving money terms) is earning interest on your money over time – and is one of the best ways to multiply your money passively. Compound interest allows your money to grow over time rather than just letting it sit and do nothing for you.

The basics of compound interest

There are a few elements that affect how much compound interest you will actually receive on your savings or investments.

- The interest rate

- The time frame and how many years you have to grow

- The tax rate – some accounts are tax-free, such as a Roth IRA.

- Interest: The cost of borrowing money and is typically expressed as a %

- Simple Interest: Interest that is paid on the original amount of cash (or principle) you save or invest

- Compound Interest: Interest that is paid on the money you initially save or invest PLUS the accumulated interest you have already earned

- Compound interest is the best type of interest because it provides the greatest return for your money.

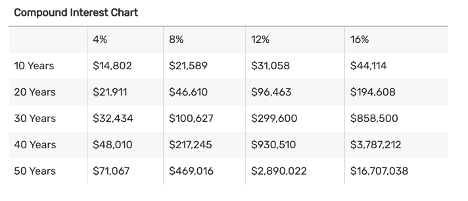

Refer to the chart below (calculations assume a $10,000 lump sum investment)

How compound interest is calculated through time periods

Compound interest can be calculated in different time periods. The most common time period to calculate interest is annually, or yearly.

• Annual (once a year) most common

• Quarterly (4 times per year)

• Monthly (12 times per year)

• Weekly (52 times per year)

• Daily (365 times per year)

Additionally, there is a complex formula to calculate compound interest, but the simplest way to calculate it out is by using a calculator. You can find a great compound Interest calculator here.

The time value of money

Have you ever wondered if a dollar is more valuable today or tomorrow?

The answer comes from the time value of money (TVM) which states that a dollar is more valuable today. The time value of money concept intertwines with the importance of compound interest because a smart investor knows the concept of compound interest. Money today is worth more because of the potential to invest it and earn compound interest over time.

Rule of 72

- The Rule of 72 is a quick tool to figure out how many years it would take to double your money. It is a super simple tip to use and is an excellent way to remember compound interest.

- Ex: If you want to know how long it will take to double your money at 6% interest, just divide 6 into 72 to get 12. It will take approximately 12 years to double your money. (This assumes yearly compounded)

- Ex: If you want to double your money in 6 years, you can also divide 6 into 72 to find what interest rate you must-have, which is about 12%

Time is on your side

Time is on your side when it comes to compound interest. Starting to save and invest money early will always be better compared to starting later in your life. You can see how much more money you will save if you start early in the example below. Both Katie and Jill contributed a one-time payment of $5,000 at the same 8% rate of return – the only difference is their ages.

- 20 year old named Katie (8% return): Her original one-time investment of $5,000 would grow to about $160,000 at age 65.

- 39 year old named Jill (8% return): Her initial one-time investment of $5,000 would grow to about $40,000 at age 65.

In conclusion

In conclusion, compound interest is the type of interest you want to be earning on your savings and is there to work for you, not against you. There is no trick or gimmick to make your money work for you, but compound interest is a valuable tool to help your savings grow faster.

Ashley is a finance graduate from the University of San Francisco and currently works at a financial technology startup in San Francisco that is focused on providing affordable and accessible 401(k) retirement plans to other startups and small businesses. Prior to working at a startup, she was an associate at a large private wealth management firm working with high-net-worth clients. She is born and raised in Orange County, CA, and loves spending time at the beach, in a pool, reading, and with her friends.