Have you ever looked at your paycheck and thought to yourself, “Am I missing money? I thought I got paid more!?” Well, I have too. Unfortunately, this missing money is due to taxes in California.

Paycheck stubs are generally divided into four main categories:

• Personal information

• Earnings

• Deductions

• Withholding

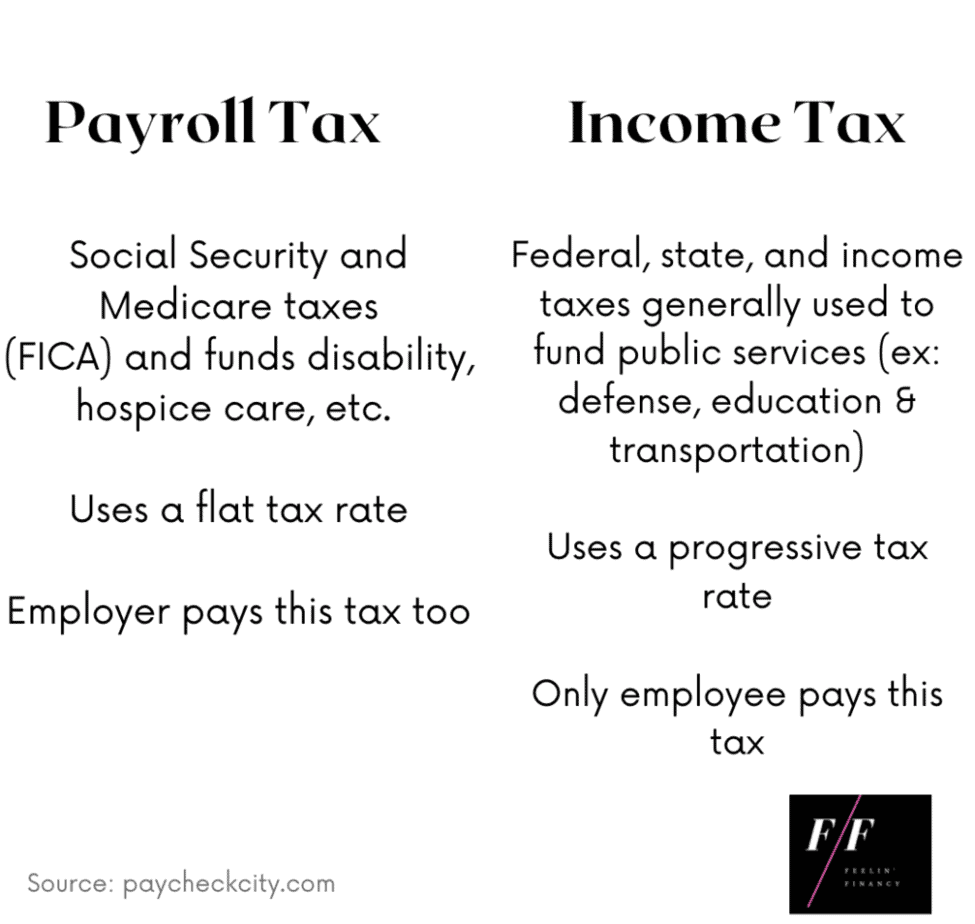

We will be solely focusing on the withholding portion (taxes withheld) in this post and what the withheld numbers mean. Before we dive into what these withheld numbers mean, what do paycheck taxes consist of? Paycheck taxes include two buckets: income tax and payroll tax.

Income tax is the tax on an employee’s earnings – and is a tax either on an employee’s wage or salary that they must pay. Income tax refers to federal, state, and local income taxes and is not a single flat rate but is based on a federal withholding calculation. Income tax is a source of revenue for governments and generally is used to fund public endeavors for citizens.

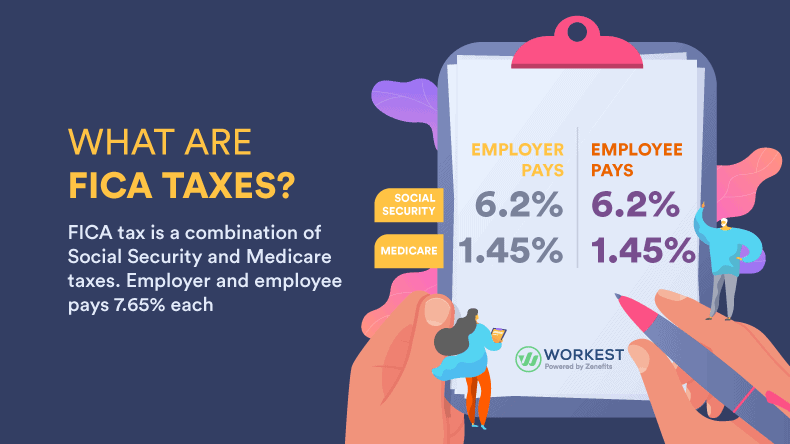

Payroll tax goes to social security and Medicare (FICA), and are taxes paid to fund these programs. Payroll taxes are paid by both the employee and the employer, with both parties essentially splitting the tax bill. Unlike income tax, payroll tax uses a flat rate calculation.

According to the EDD, In California, state payroll taxes that the employer pays include Unemployment Insurance (UI), and Employment Training Tax (ETT). The other two taxes that employees pay include State Disability Insurance (SDI) and Personal Income Tax (PIT). Note that some types of employment are not all subject to payroll taxes and PIT withholding taxes.

Although tax is a tricky concept, I will talk about the taxes withheld on my own paycheck (and probably yours too) and what they mean. I am not a tax consultant, but I hope this helps those wondering what the withheld numbers mean. By breaking down each line item, I hope to give you some insight into what exactly you are paying for in tax through your paycheck.

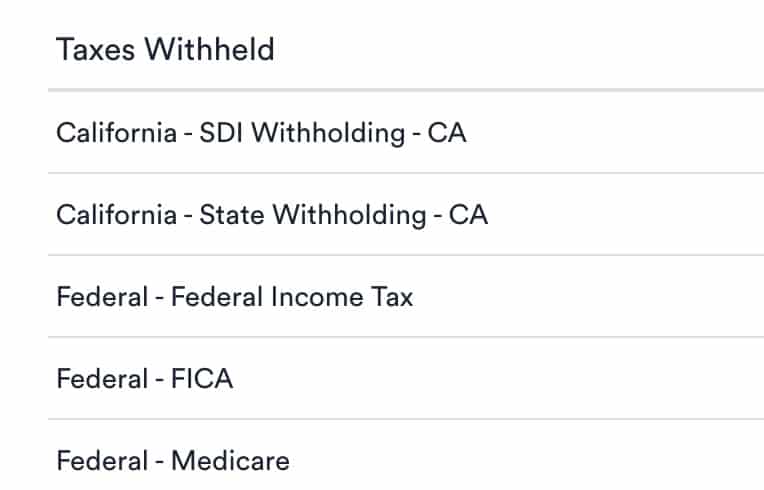

The employee payroll taxes withheld on my own paystub include:

- California – SDI Withholding – CA

- California – State Withholding – CA

- Federal – Federal Income Tax

- Federal – FICA

- Federal – Medicare

California – SDI Withholding – CA tax

The first line item under the deductions include SDI withholding. SDI stands for “State Disability Insurance” tax and provides temporary benefit payments if you ever get injured, pregnant, or if you need to take a personal family leave.

California – State Withholding

The second line item is federal tax withholding and is calculated based on your W-4 form information. This deduction is from the California state tax law and depends on your total income.

State tax withholding depends on where you live, so you may not have any state withholding tax depending on which state you reside in. Some people also may have state withholding tax for more than one state if they live in a state different than the state they work in.

Federal – Federal Income Tax

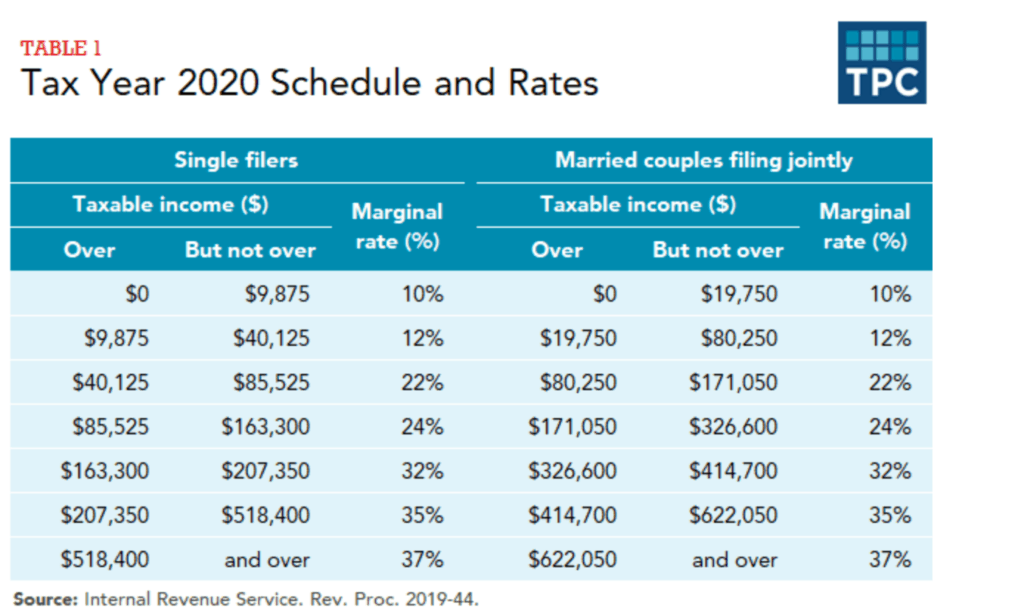

Federal income tax is based on a progressive rate – and has seven tax rates ranging from 10%-37% based on taxable income figures.

A progressive rate means that as taxable income increases, the tax rate also increases. Refer to the chart below to see what the schedule and rates are for 2020.

Federal – FICA

FICA is a deduction from payroll tax and stands for Federal Insurance Contributions Act. FICA helps fund Social Security, Medicare, and other programs that create benefits for retirees, disabled people, and children.

Employers and employees “split” the FICA tax, and both pay 7.65% each.

Federal – Medicare

Medicare is another deduction from payroll tax and is similar to Social Security benefits. Similar to Social Security, Medicare gets funding through employment taxes.

Medicare is the federal health insurance program for people over age 65, certain younger people with disabilities, and people with ESRD, or permanent kidney failure.

Closing Thoughts

Overall, seeing withheld numbers and paying tax on your hard-earned paycheck is never fun. Although it may seem like a big chunk of money going to unnecessary things, hopefully, the taxes you are paying for now will be of service to you down the road when you need them.

Try to stay focused on the positive, and remember that most working people have to pay tax. I don’t think we will ever escape taxes, so we are better off just learning about them rather than fighting it.

Ashley is a finance graduate from the University of San Francisco and currently works at a financial technology startup in San Francisco that is focused on providing affordable and accessible 401(k) retirement plans to other startups and small businesses. Prior to working at a startup, she was an associate at a large private wealth management firm working with high-net-worth clients. She is born and raised in Orange County, CA, and loves spending time at the beach, in a pool, reading, and with her friends.