Are you interested in renting out an apartment or plan to rent an apartment in the future? If so, it’s essential to understand what bills you will have to pay when you rent out an apartment.

Renting out an apartment is a big decision and shouldn’t be taken lightly. If you plan on renting an apartment, you should take careful time and consideration to figure out your apartment wants, needs, and budget.

An apartment’s cost can add up quickly if you aren’t aware of the associated expenses and bills that come with the monthly rent cost.

Since I have been an apartment renter in San Francisco, I will use this article to discuss my experience as a renter and discuss the extra costs, bills, and prices associated with renting an apartment.

Although renting fees will differ with the location, it’s important to understand what bills you may have to pay when renting an apartment. Sometimes the landlord will even pay for some of these associated costs to entice renters (like water, for example), which I will explain more about in greater detail throughout the article.

When renting an apartment, you should generally expect to pay:

- A fixed monthly rent cost (recurring monthly)

- A security deposit cost (only once)

- Water bill

- Heat/air conditioner bill

- Internet and cable bill

- Renter’s insurance

- Parking space (depending on the city you live in)

A fixed monthly rent cost

The first and most apparent bill you have to pay when you have an apartment is the fixed monthly rent cost paid to the landlord of the apartment unit.

When you rent an apartment, the monthly “rent” is the money that you pay the owner each month to occupy the space. The rent amount is a fixed amount and usually doesn’t include utilities or extra bill costs.

Depending on your lease period (usually a 1-year lease), you will be expected to pay the fixed monthly rent cost until your lease ends. A lease is a contract that outlines the dates you are expected to pay for. After your lease “expires,” you are usually given the option to either renew the lease or find a new place.

If you are interested in learning the median apartment price for one or two bedrooms, check out this free tool at Apartment List to see what median apartment prices are in the United States.

If you already know your monthly apartment cost, write this number down and keep track of all the extra bills that will be added to this base number after you figure them out with your landlord or roommates. The number you wrote down will be your “base” cost and won’t include the additional bills and expenses of renting an apartment.

In this article, you will learn more about the additional costs that may be added to your base rent.

Security deposit cost

When you decide to rent an apartment, there will most likely be a security deposit cost. When I first moved into my apartment, my security deposit amount was one full month’s rent.

A security deposit is a one-time payment that you must pay when you first rent an apartment. The good news here is that the security deposit does not reoccur every month as your rent payments do.

This extra money you pay will stay with the landlord until you move out and is used as “security” money if you happen to damage the apartment and break a window. If you don’t damage the apartment or move out before the lease is up, you will be given back your full security payment at the end of your lease.

If you want the full security payment back, be sure to take care of your apartment!

Utilities

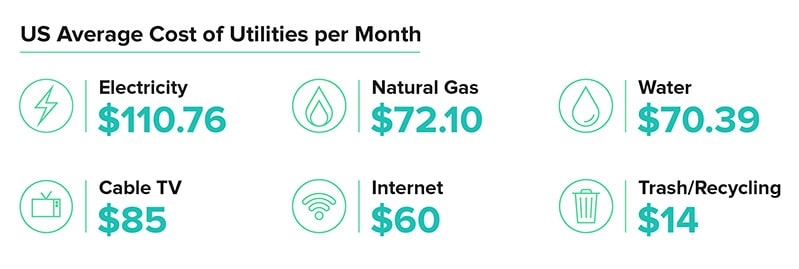

When renting an apartment, you should expect to pay monthly utility costs.

When searching for apartments, you will sometimes notice that the posting could say something like “trash and water utilities included,” which means that you won’t be responsible for paying trash or water but will have to pay for other apartment utilities.

Let’s dive into a few common utilities: water, heat/air, internet, and cable.

Water bill

Water is an integral part of living, and you’ll need water to shower, drink, and wash dishes.

In my apartment, the water bill was paid by the landlord and was included in my rent. If it’s not included in your rent, you will have to pay a separate monthly water bill.

The average cost of utilities varies by state, but for California, the average water bill is around $65. If you have roommates, you can expect to split that bill between all roommates.

Gas – Heater

Depending on where you live, your gas bill will vary. Gas in your apartment is what produces heat and is what keeps you warm and cozy – it’s your heating system! Our gas bill usually ranged somewhere between $60 and $80 per month, split between three girls in my apartment.

Air conditioner

Air conditioners in apartments can be a costly bill for many. Depending on where you live, you may need to turn the air on longer than others.

If you notice that your air conditioner is costing much more than you planned but know you need to keep it, it would probably be best to restructure your budget.

A quick and easy tip to combat using the air conditioner too often is by buying a small mini-fan to put in your house, which I talk about in my article, “3 Simple Saving Tips For Your Remote Workspace – Working Remotely On a Budget.”

Internet and cable

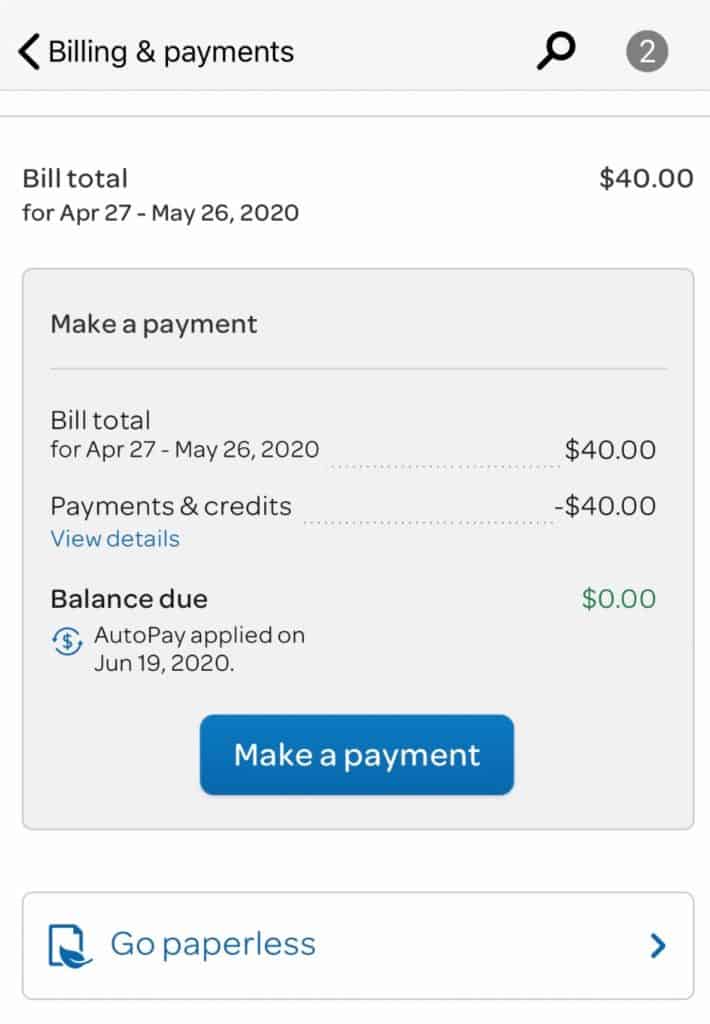

Internet and cable are optional bills but are nice to have if you can afford them. I only paid for the internet because my roommates and I didn’t think we needed cable (since we mainly watched Netflix). There are many different internet providers, but we decided to go with AT&T.

Our internet bill came out to about $40 per month with AT&T. I have included a screenshot below of what our AT&T bill looked like. It was effortless to pay this bill each month online. You can usually set up online payments very easily if you prefer to pay online.

Renters insurance

If you want to protect your belongings in your apartment, you’ll need renters insurance.

Renters insurance is something I knew nothing about and never got until my apartment lease ended, and is something I wish I knew about before.

If you are renting an apartment, you don’t have to worry about the actual building (or structure) you live in getting damaged. However, you will have to protect the items inside the apartment or all of your personal things.

Renters insurance covers events in case of a burglary, kitchen fire, or accidents to guests. If you want to learn more about renters insurance, I have heard that the provider Lemonade is easy and affordable.

You should expect renter’s insurance to run anywhere between $5 and $30 a month.

Parking space

In San Francisco, no one expected to own parking space. It is actually recommended to not bring a car with you unless you have to.

In cities like San Francisco and New York City, you shouldn’t have to bring a car. But if you must, you will have to pay a pretty large amount of money for a parking space.

Near my old apartment building, parking spaces started at $200 minimum a month – not cheap! If you are renting an apartment and bringing your car, always make sure you know the parking costs at or near your building.

Figure out your monthly apartment cost

To get a better idea of what you will be paying per month overall, it is best to create a small and easy budget tracker specifically for your apartment rent.

Start by reading my article “How Much To Save Each Month – A Quick Money Rule” to get a better idea of what your average apartment budget should be.

What bills do you have to pay when renting an apartment?

When renting an apartment, you’ll be expected to pay the monthly base rent, a one-time security deposit, and most likely other bills such as water, heat and air, internet and cable, renters insurance, and a parking space (if you have a car).

Depending on your apartment and your apartment’s location, these requirements will vary. Always read your full lease contract and ask many questions before signing a lease.

How should I find apartments for rent?

Once you have decided that you can afford to rent an apartment, you’ll have to start looking for one! Searching for an apartment can be a fun part of your apartment hunt process but can also be stressful if you don’t know what to do.

When I was looking for an apartment, I joined as many Facebook groups as I could. Facebook groups are an easy way to find fully furnished apartment rooms and roommates.

If you are looking for your own apartment or a place for you and your partner, websites like Zillow and Trulia can be a great resource.

What documents do I need to rent an apartment?

When I was searching for an apartment, I made sure to have a few documents ready such as a paystub, a source of I.D, social security number, and references.

The documents that I needed to rent an apartment included:

- A work paystub – A paystub is used to prove that you have a source of steady income.

- I.D – a government-issued I.D verifies your identity. The types of I.D that I keep handy include my driver’s license and passport.

- Social security number – Your social security number can be used to run a background check on you. I always keep a paper copy just in case.

- References: References and recommendations are a popular thing to ask for by potential landlords and roommates because they want to make sure that you have a history of paying your rent on time and being respectful.

Other documents that may be requested from you when renting an apartment include:

- Bank statements (usually if you don’t have a paystub available)

- Vehicle registration and proof of insurance (only needed if you plan on bringing a car with you)

- Resume

- Checkbook – checks are generally used to pay your landlord. Although checks are outdated, checks are the most official way to pay your landlord the rent.

- Your guarrantorr’s paperwork (if you are using a lease guarantor or someone who will co-sign your apartment if you cannot cover payments)

If you want to learn more about documents needed to rent an apartment, feel free to learn more about other common documents here.

Final thoughts

Renting an apartment can be fun when you know you can afford the rent, bills, and extra expenses that come along with renting.

When searching for apartments, be sure to fully understand what your lease says and ask your landlord what your monthly rent payment covers or does not cover.

When renting an apartment, remember to ask tons of questions, do your research, and have fun with the process. Renting an apartment is a big deal, and you should be proud of yourself for being able to do it.

Happy apartment searching!

Ashley is a finance graduate from the University of San Francisco and currently works at a financial technology startup in San Francisco that is focused on providing affordable and accessible 401(k) retirement plans to other startups and small businesses. Prior to working at a startup, she was an associate at a large private wealth management firm working with high-net-worth clients. She is born and raised in Orange County, CA, and loves spending time at the beach, in a pool, reading, and with her friends.

[…] Renting an apartment can add up quickly! If you want to learn more about costs associated with renting an apartment, read my article, “What Bills Do You Pay When Renting an Apartment?” […]